Original article by: BUILDER Online

The two companies intend to combine their land development operations and scale in shared markets.

Brookfield Residential has agreed to acquire master-planned community developer Newland. The transaction includes Newland’s management company, as well as the (5%) general partner’s equity interest in 15 out of the 20 master-planned communities Newland is developing.

“This acquisition is an investment in our long-term land business, allowing us to leverage our land development expertise to become a large-scale provider of lots to third-party builders and also provide expansion potential for the Brookfield Residential home building brand,” says Adrian Foley, managing partner, real estate and president, development at Brookfield Residential. “The acquisition of Newland adds phenomenal master-planned communities to our portfolio in exciting new markets that are experiencing tremendous growth and a lack of supply of new homes. It will round out our existing development capabilities making us one of the few companies that has the breadth of resources, capital, and operational talent to successfully scale in this area of the market.”

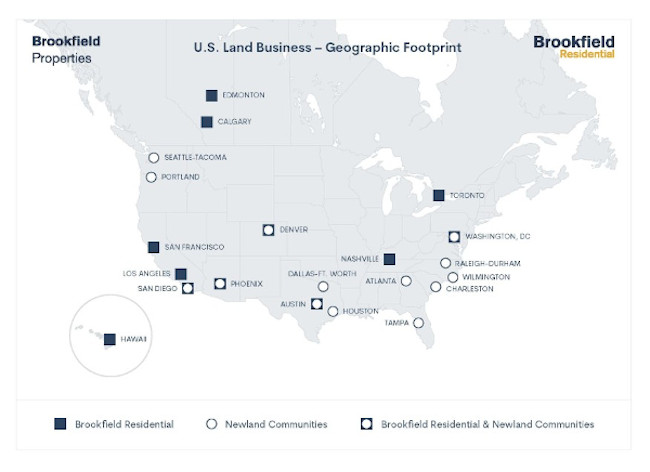

With this acquisition, Brookfield Residential is set to gain access to nine new incremental markets—Atlanta; Charleston, South Carolina; Dallas-Fort Worth; Houston; Portland, Oregon; Raleigh-Durham and Wilmington, North Carolina; Seattle-Tacoma; and Tampa, Florida. The company also will leverage its combined strength to expand offerings in five shared locations: Austin, Texas; Denver; Phoenix; San Diego; and Washington, D.C.

“We are extremely pleased to be able to team up with Brookfield Properties’ development group,” says Bob McLeod, executive chairman of Newland. “This acquisition will provide more opportunities for the continued development of additional mixed-use master plans well into the future as well as give us significant additional vertical development opportunities. We are looking forward to becoming part of the Brookfield team.”

Subject to customary closing procedures, the acquisition is expected to close June 1.