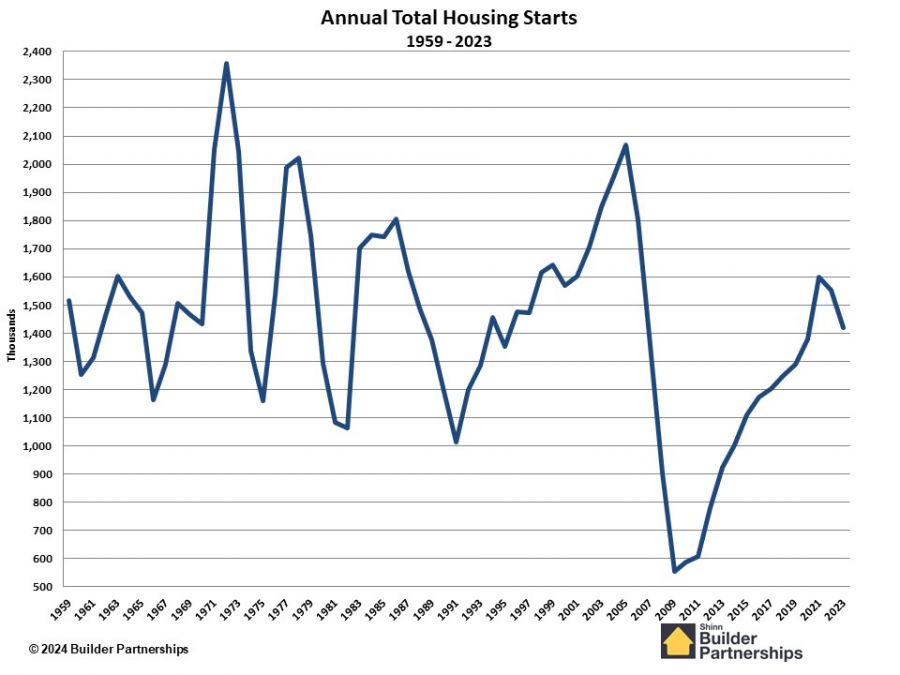

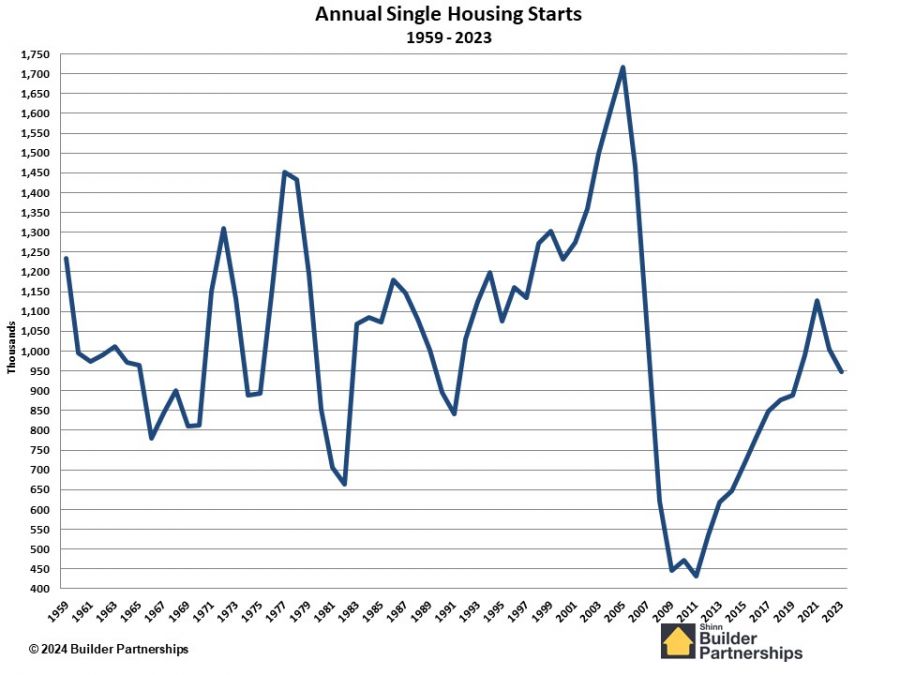

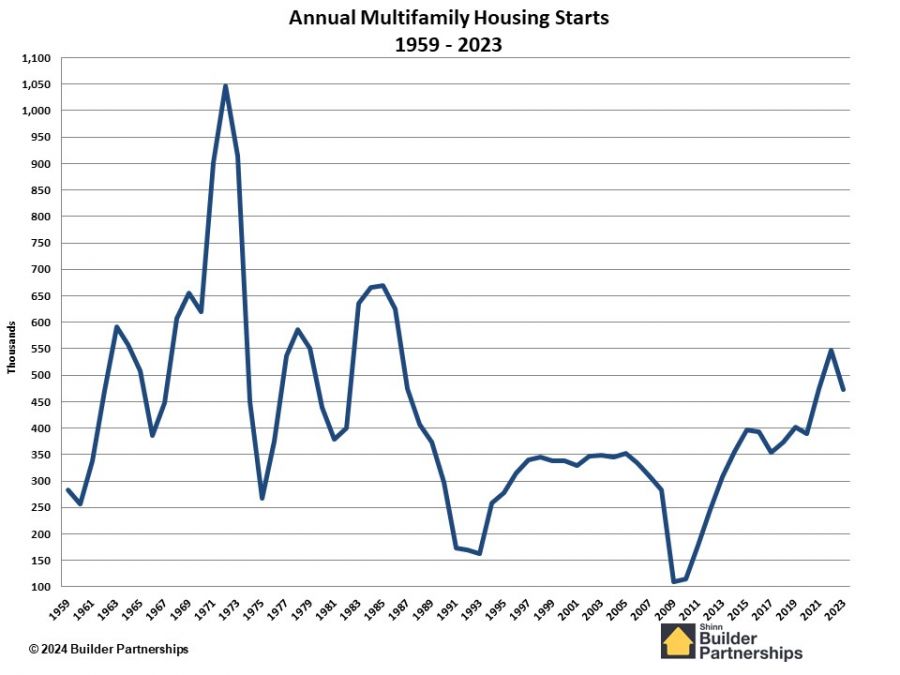

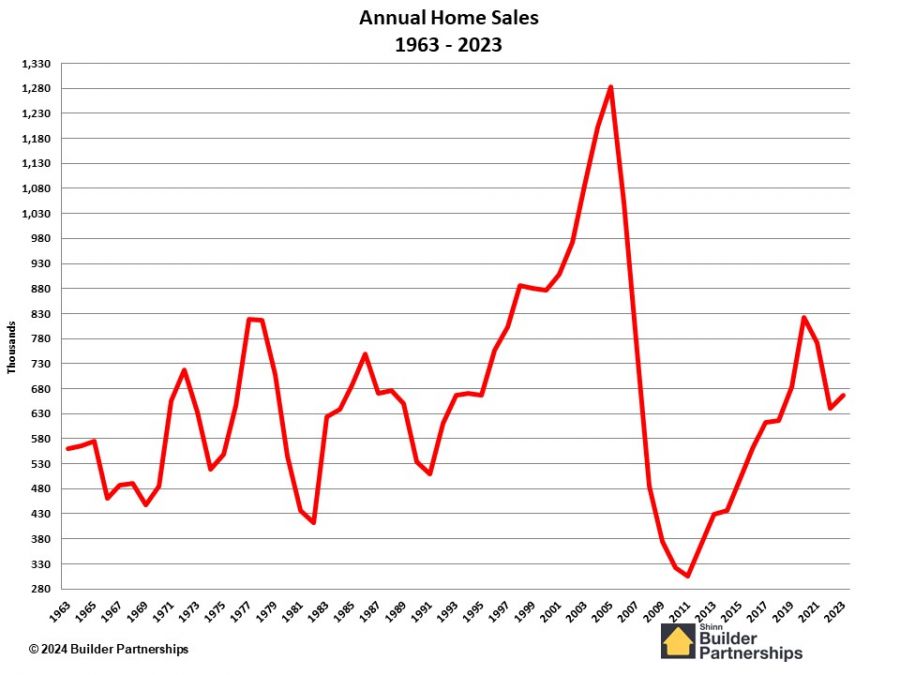

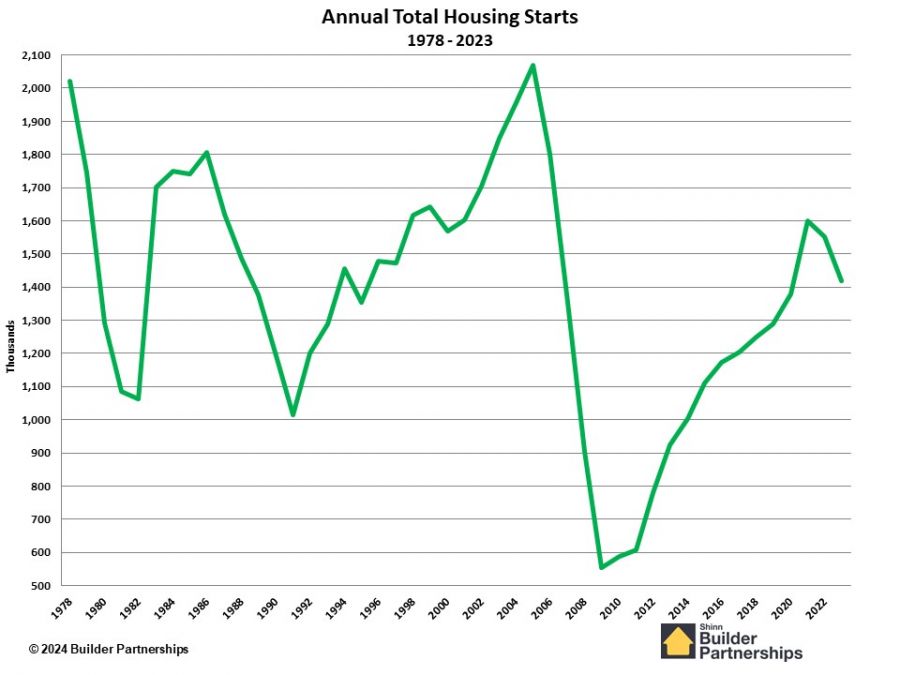

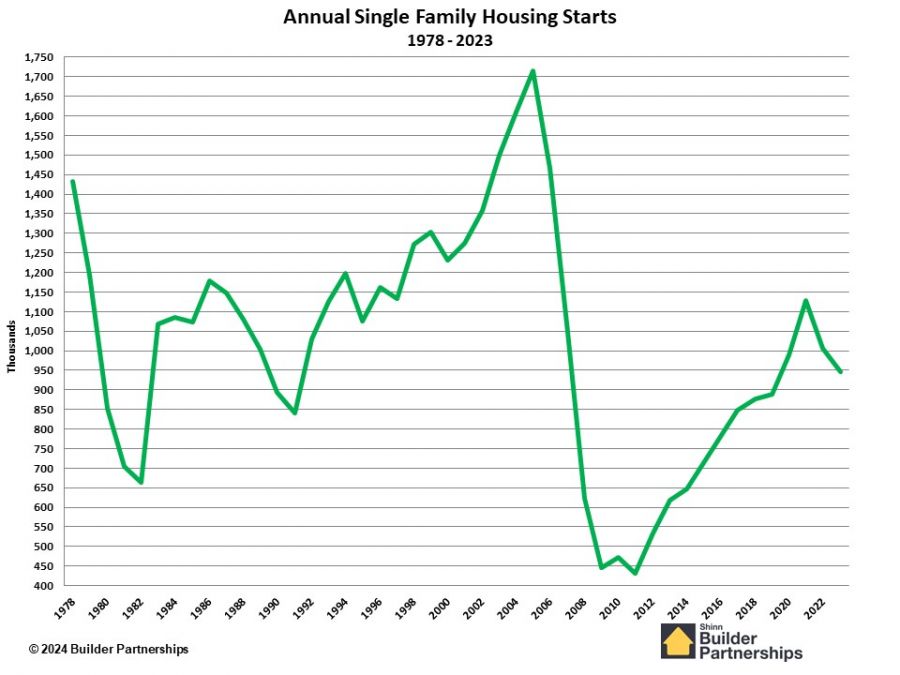

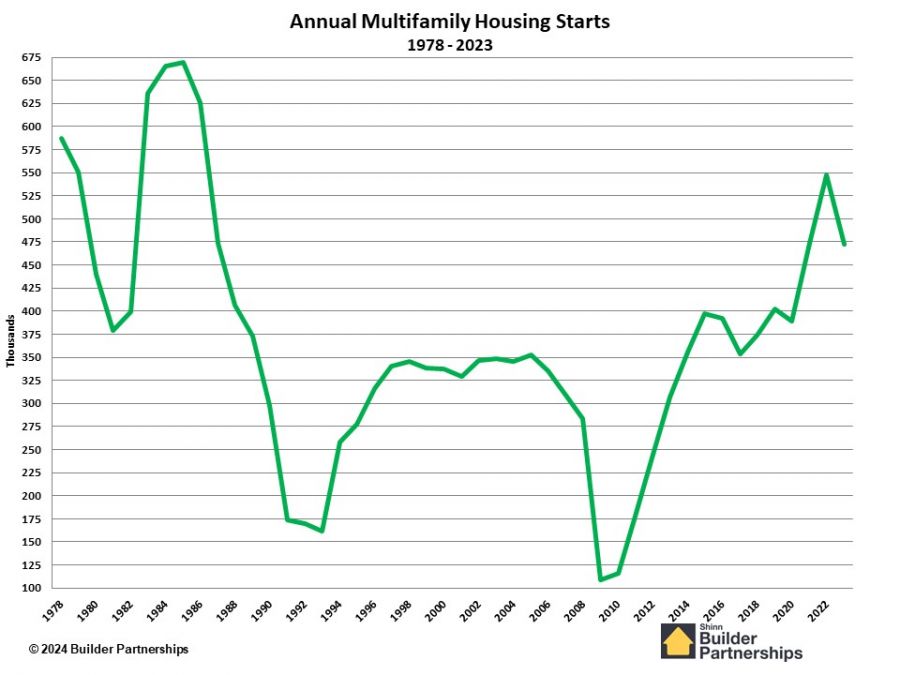

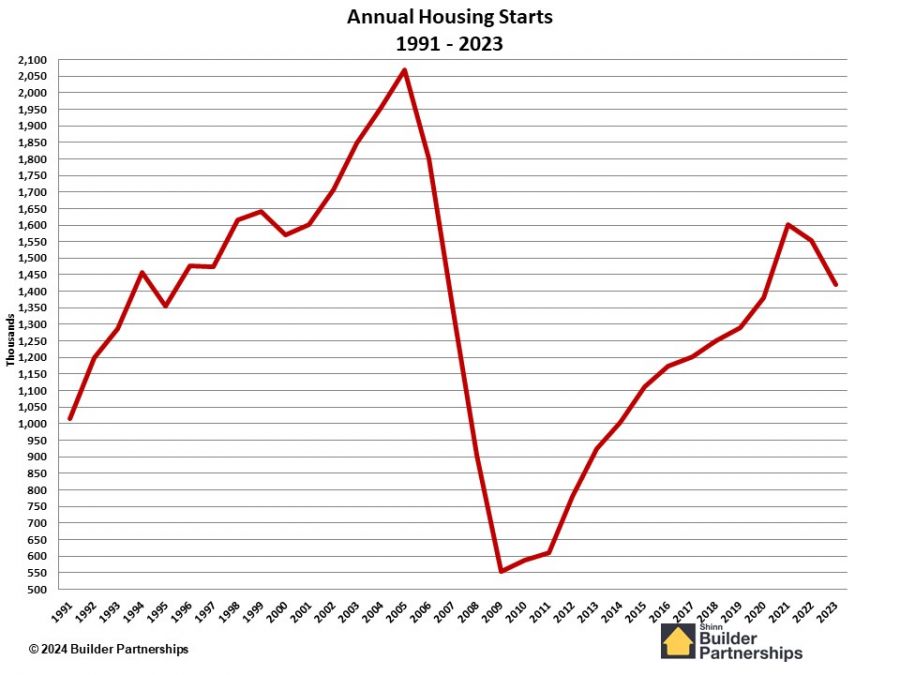

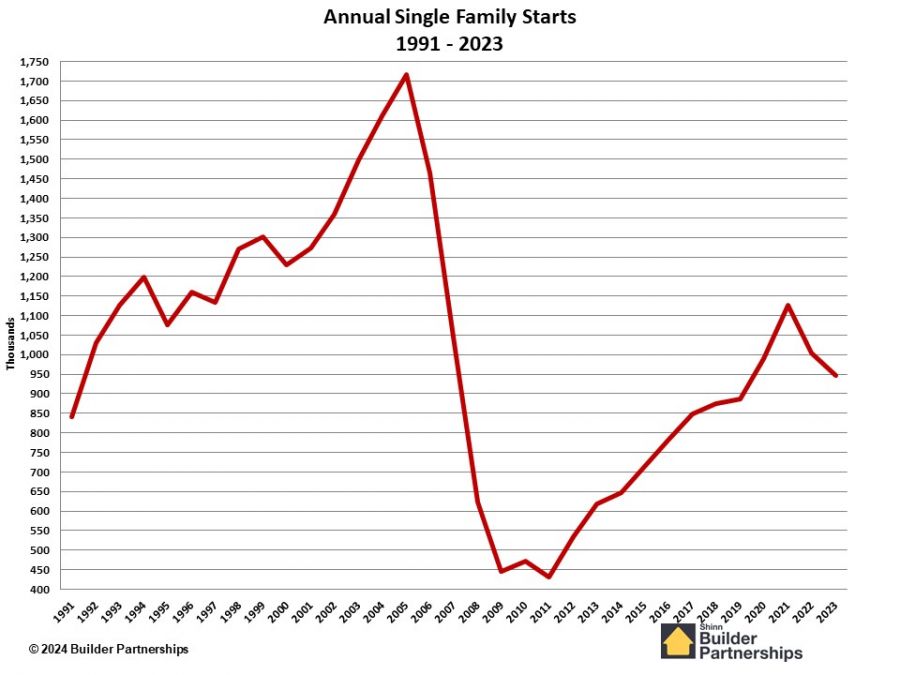

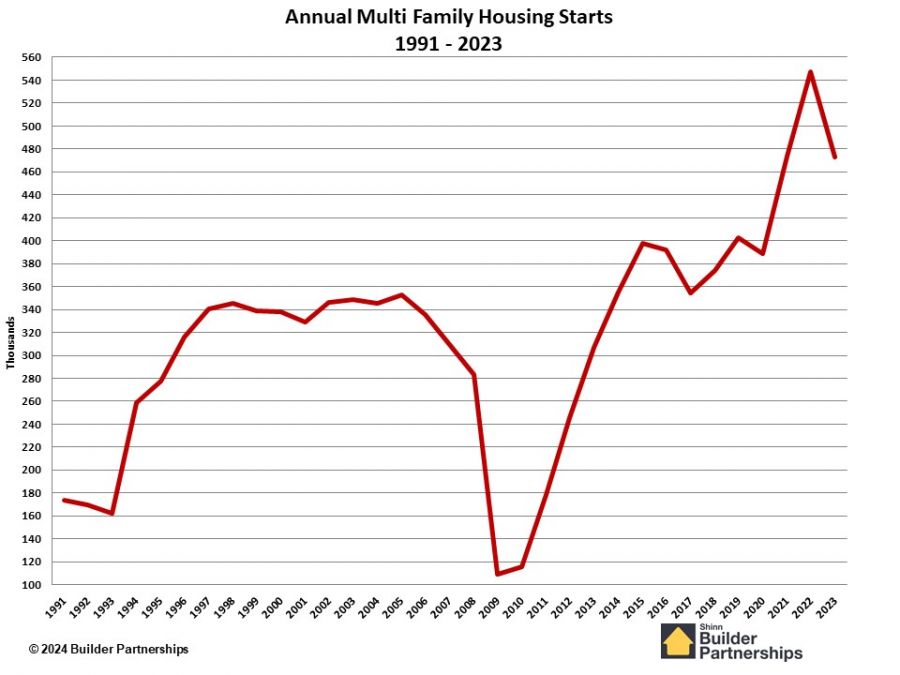

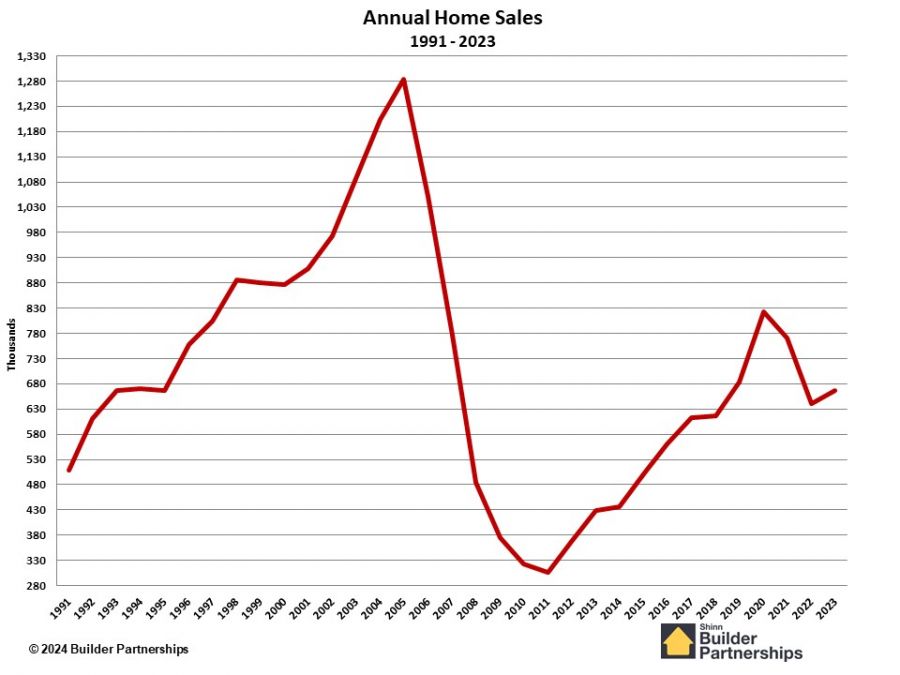

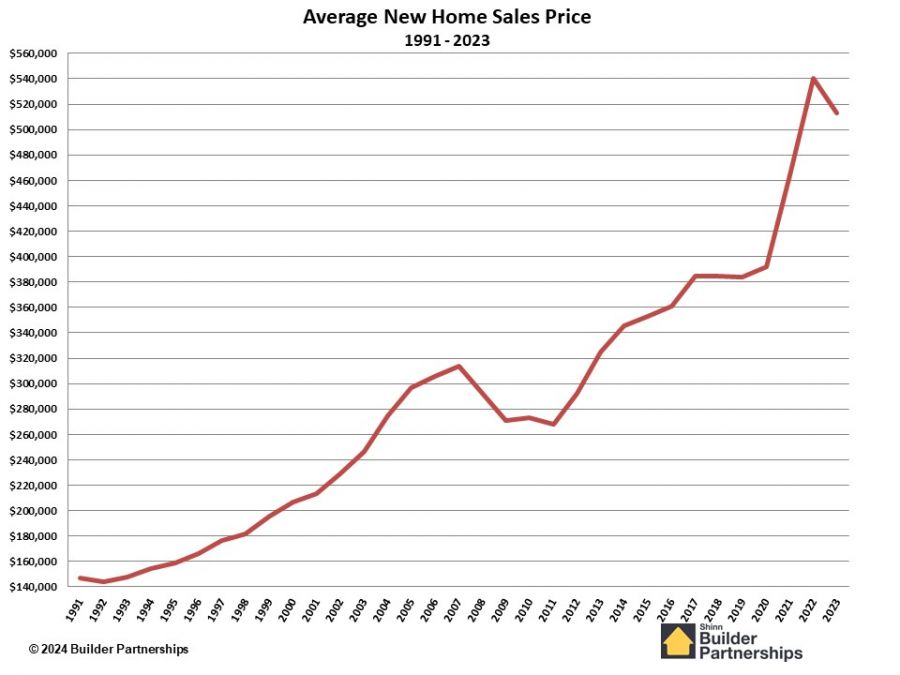

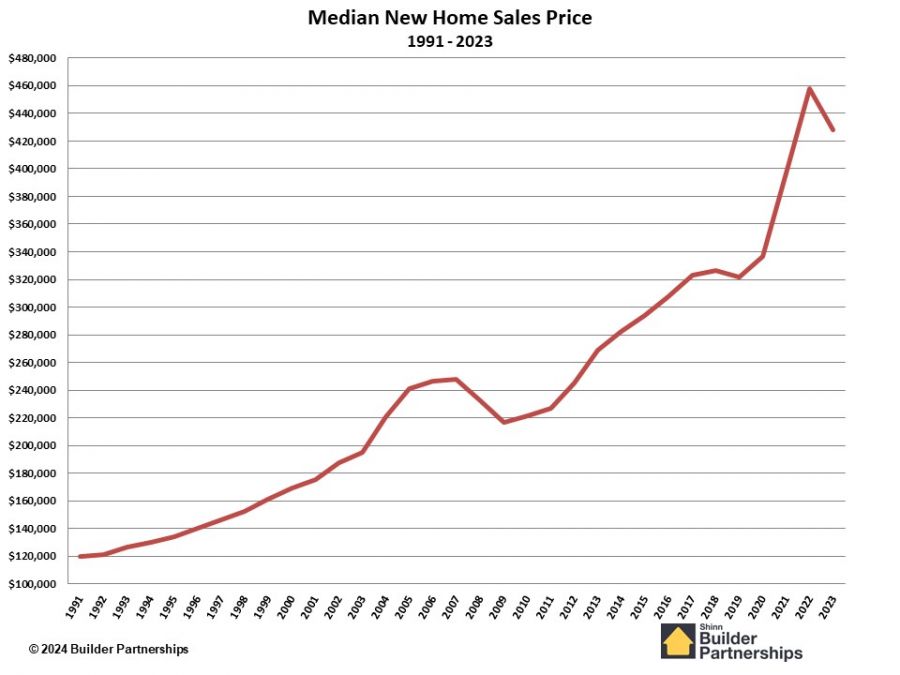

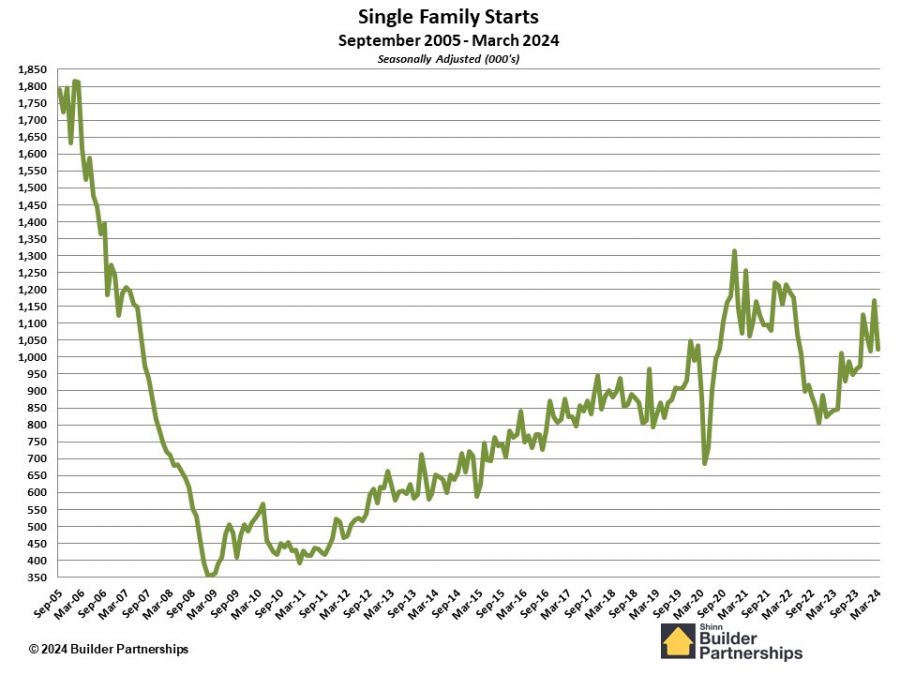

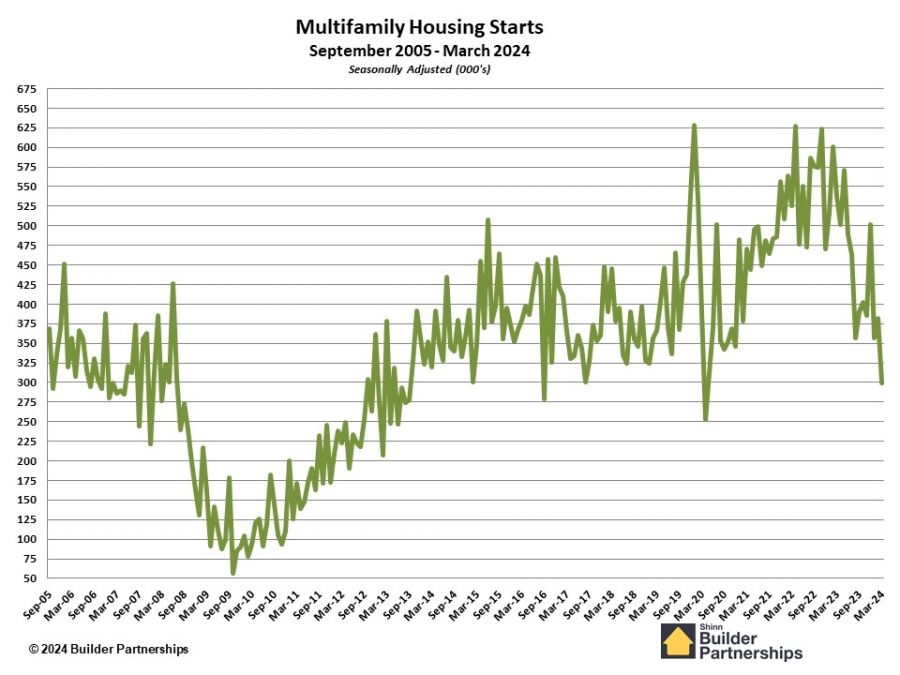

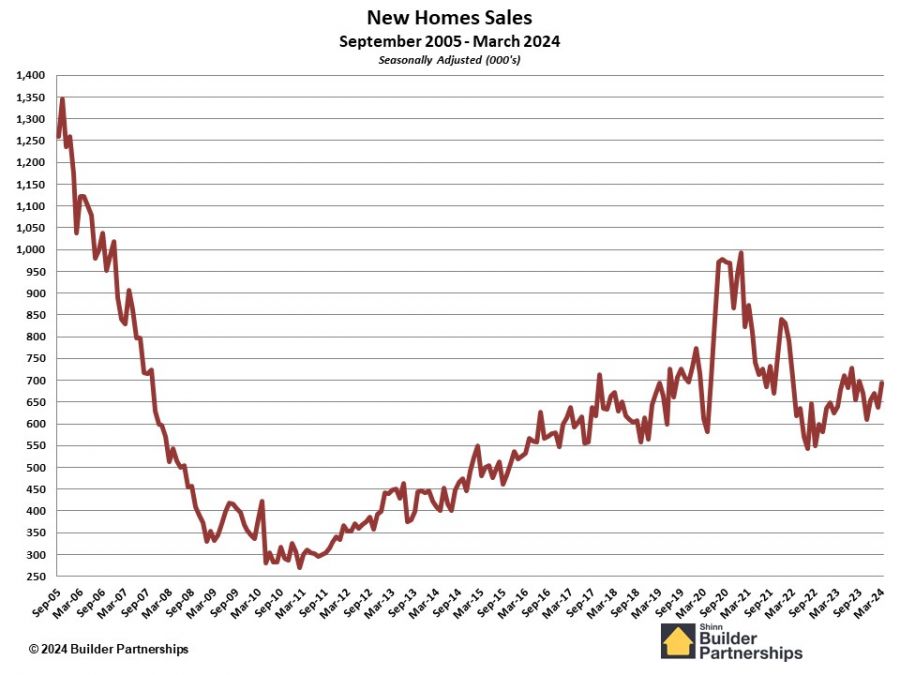

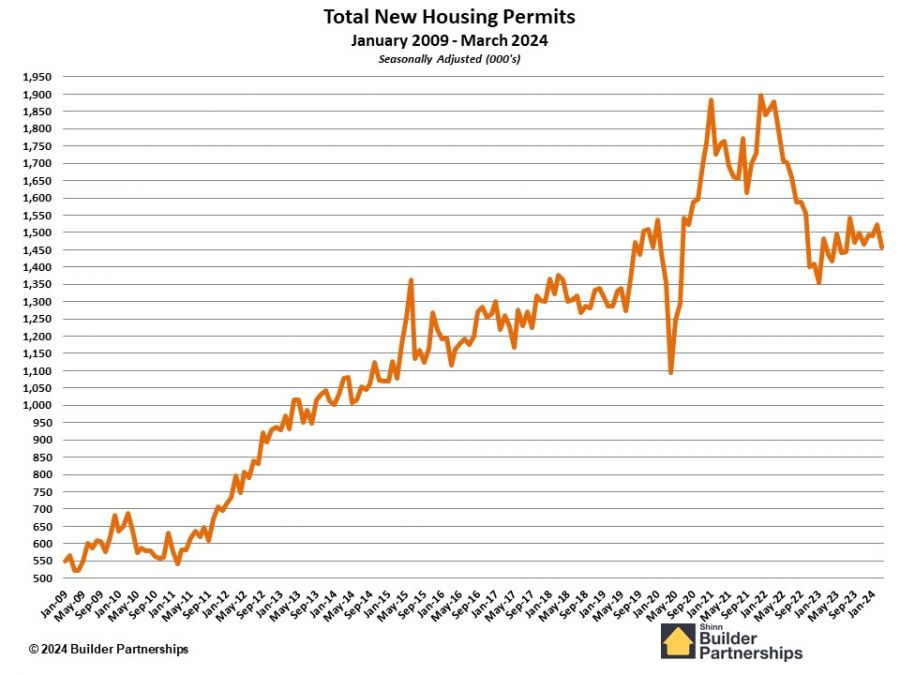

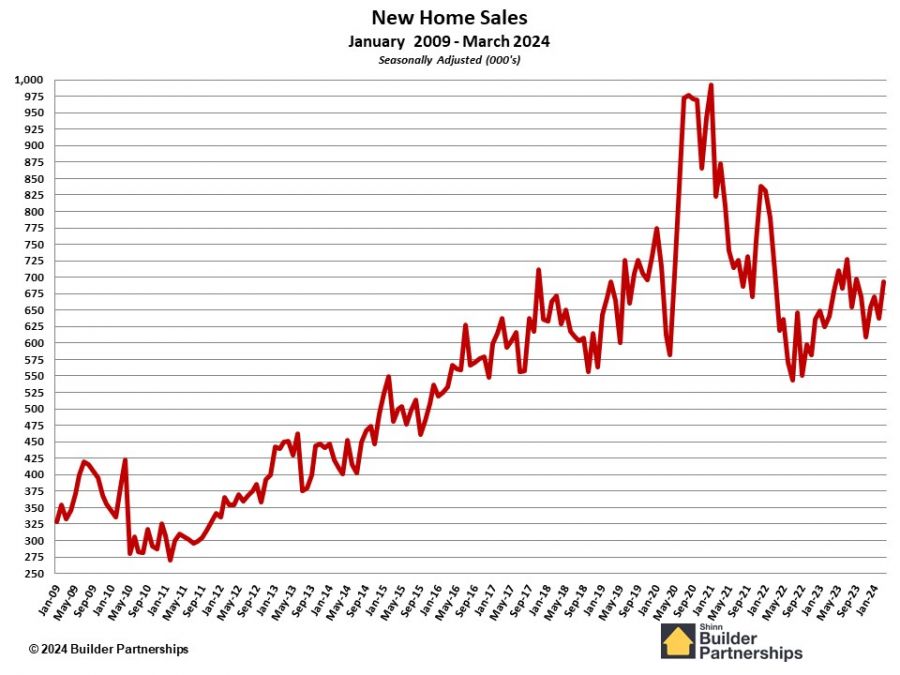

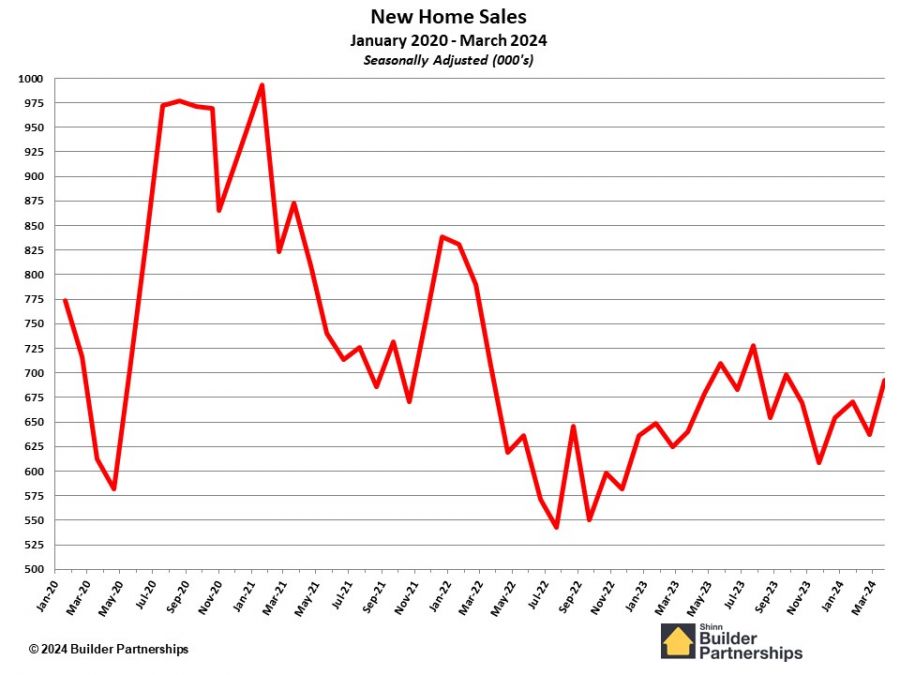

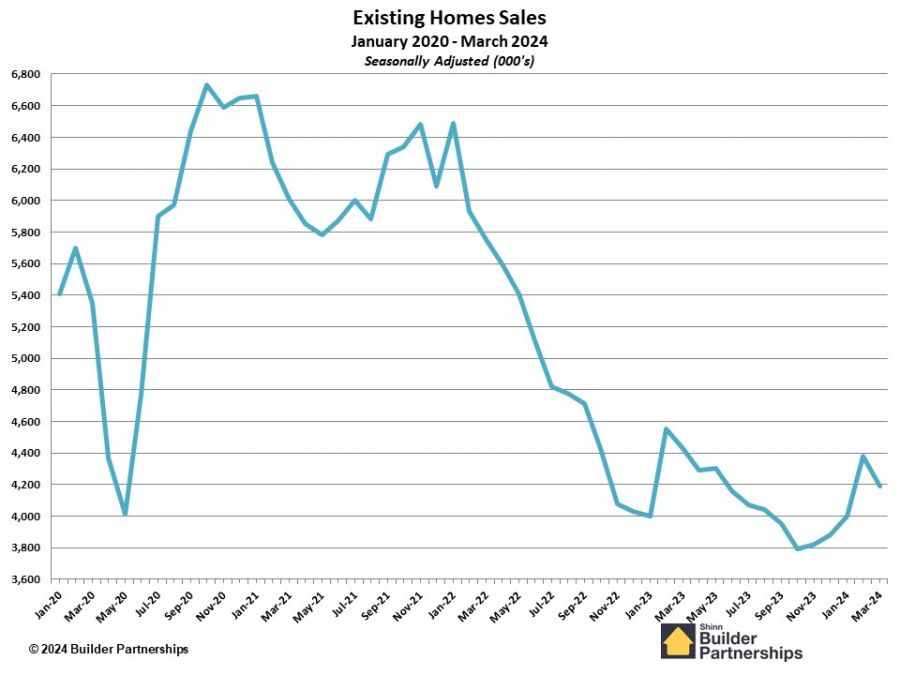

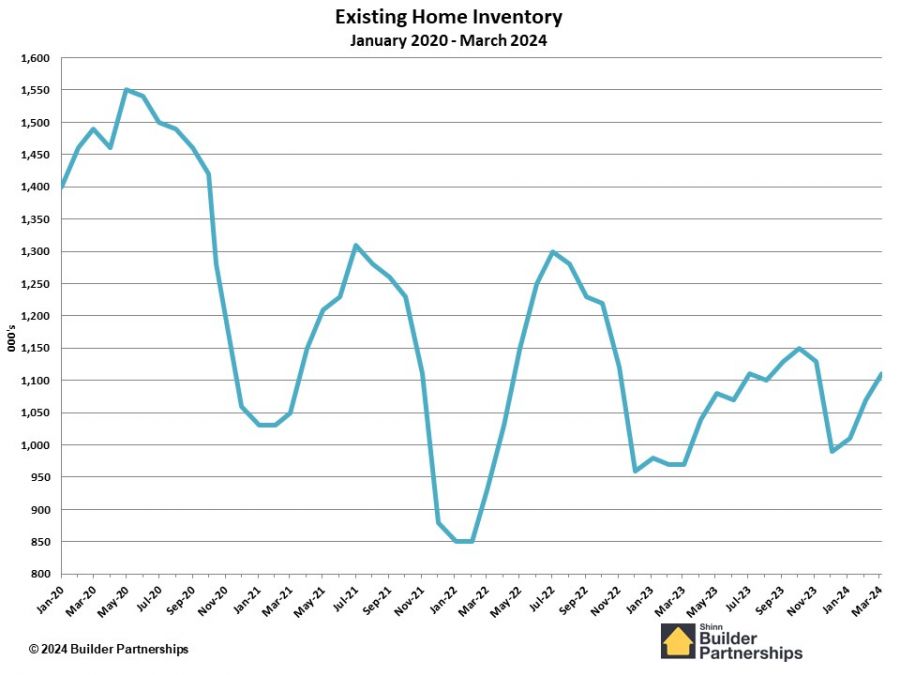

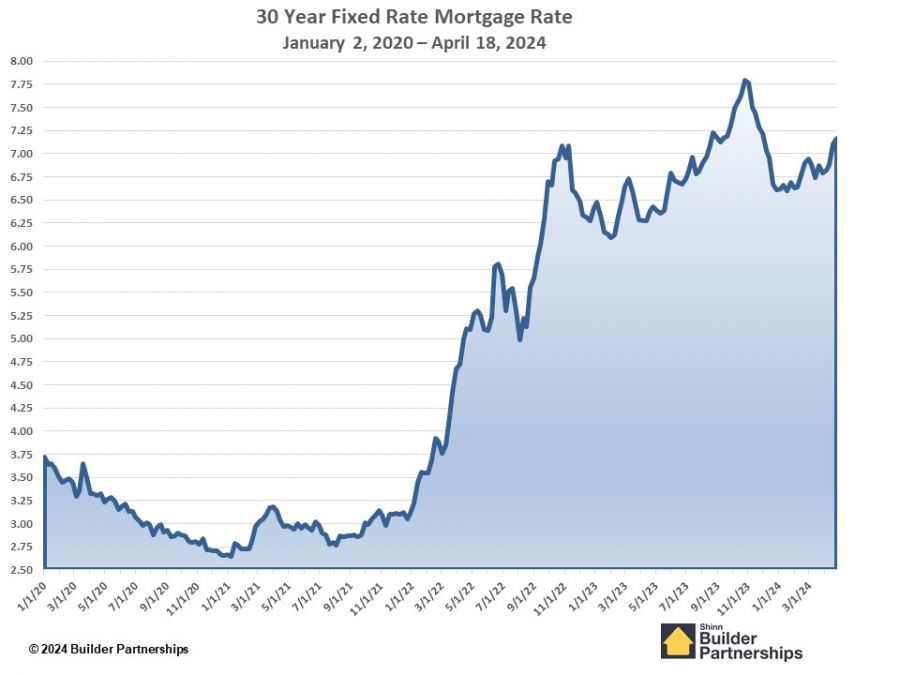

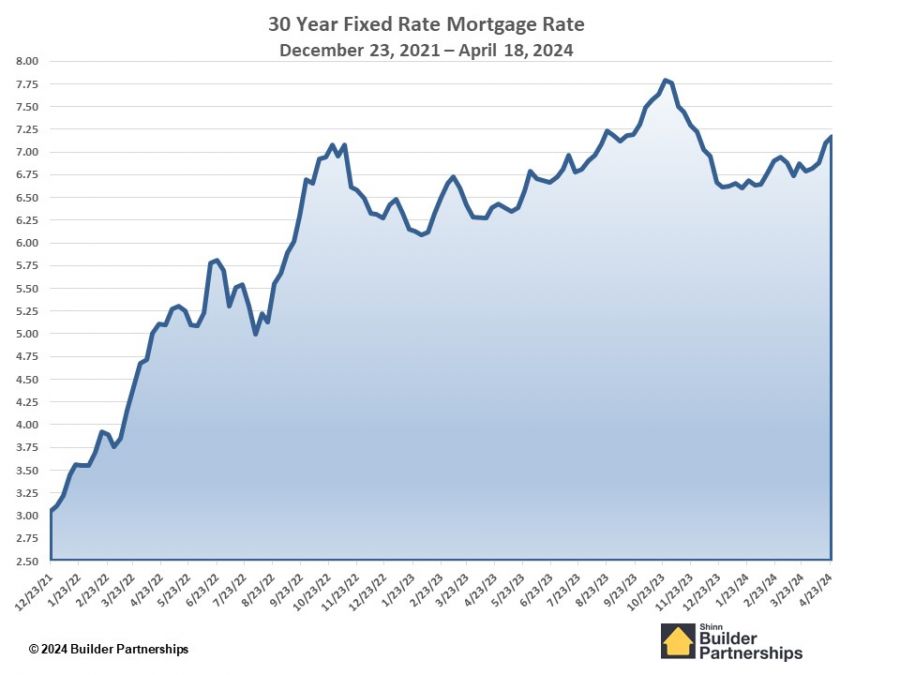

Throughout the first half of 2025, the housing market did not see the anticipated spring selling season, not due to lack of housing demand, but because of affordability problems and persistent, high mortgage interest rates. Many economists were concerned that the housing industry was experiencing a recession because of the lack of activity. The market faces uncertainty from the potential return of higher inflation driven by tariffs, as well as from labor shortages in construction tied to the crackdown on illegal immigration.

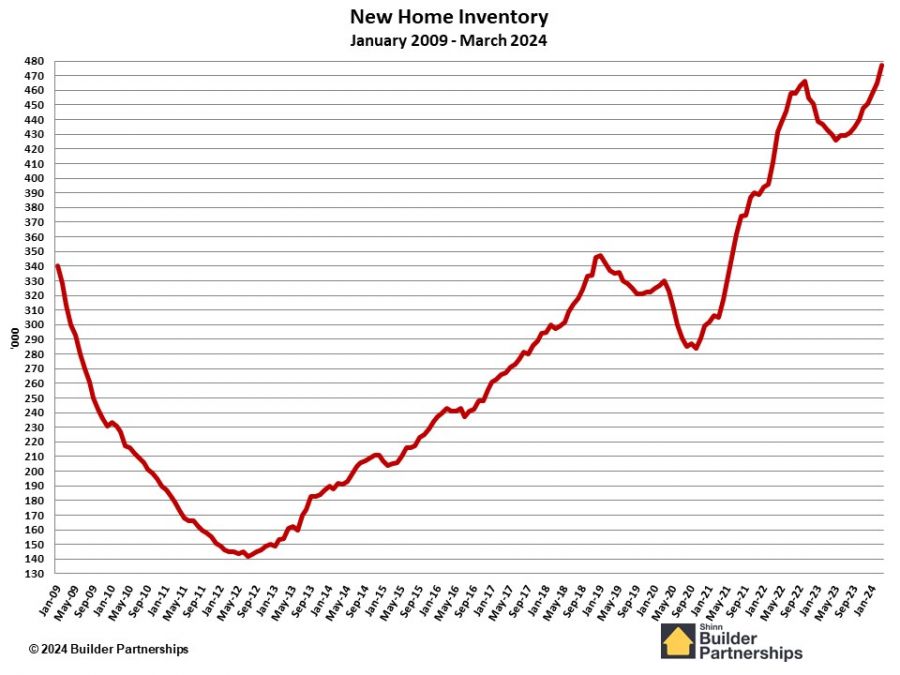

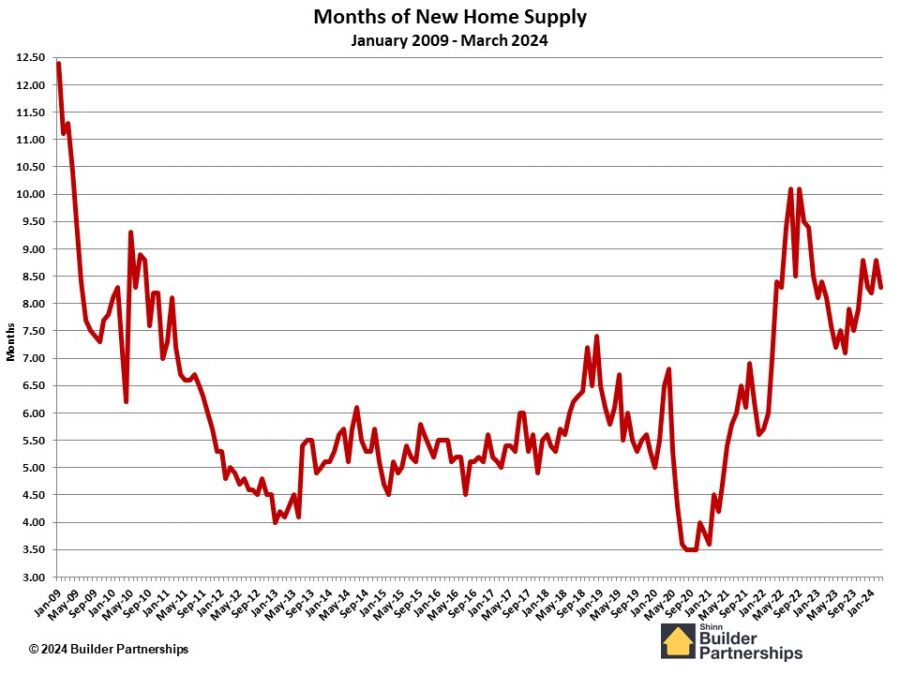

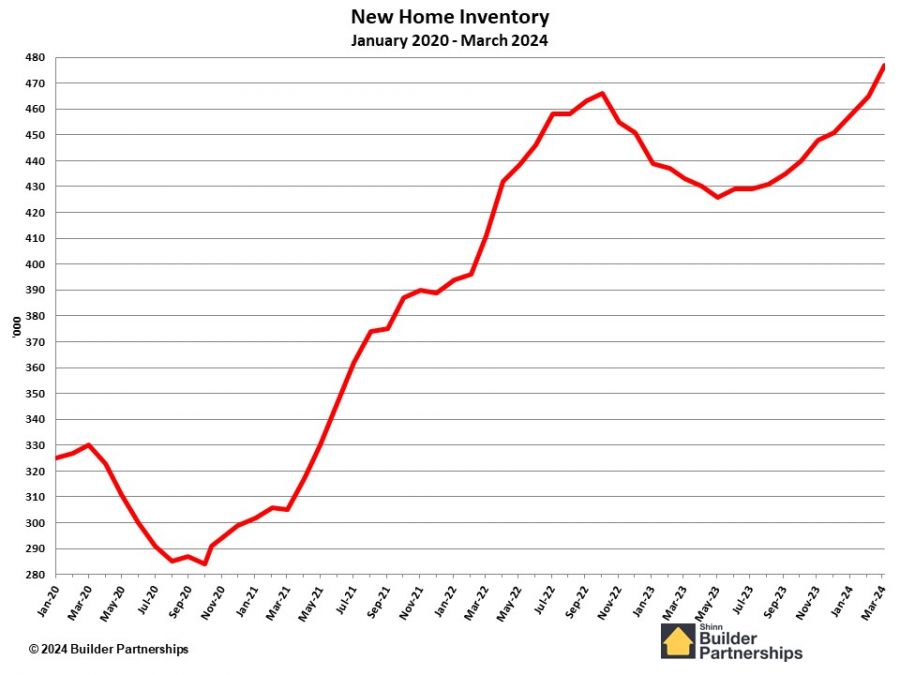

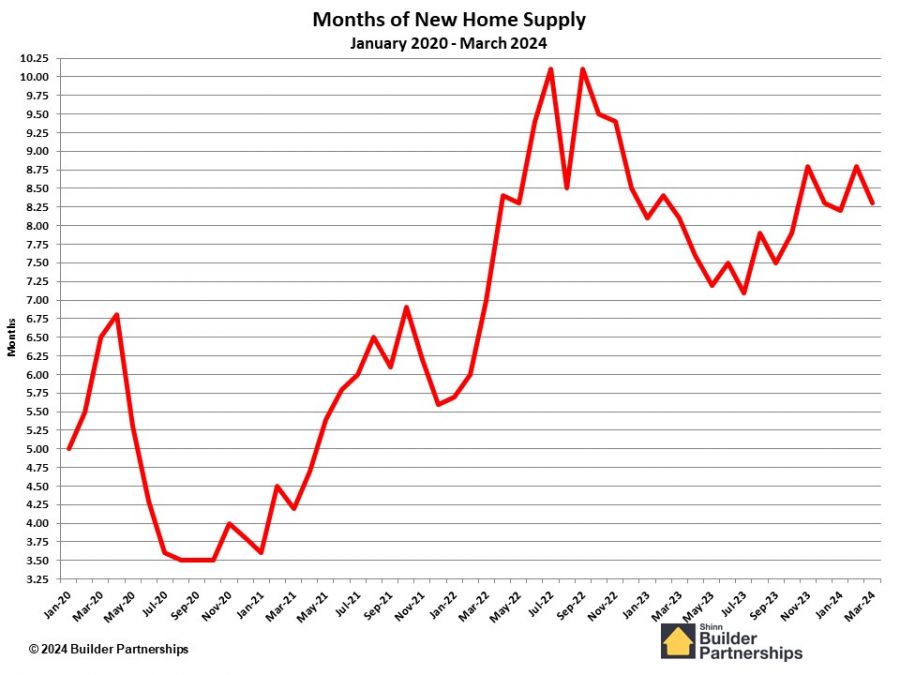

With the underperformance of the first half of the year, 2025 will end up being another weak year for housing. Home builders have been buying their market with flexible incentives of up to 5% of sales price and interest buydown programs. These programs appear to be waning. Many builders are reverting to straight sales price reductions to liquidate their bloated standing inventory or to improve their unit sales count over margin to keep their employees and crews busy. For most builders, because of the long lead times of the to-be-built homes, home closings for 2025 have concluded (except for completed or under construction inventory homes).

Looking forward, 2026 should be a banner year for housing. Housing demand is strong. The two largest populations, millennials and Gen Zers, will be either at their prime home buying age or just entering the market. The inflationary threat from the tariffs will be behind us, mortgage interest rates will be down to acceptable rates, and the current surplus of new home inventory will have been sold.

Read article

Data Updated: August 31, 2025

(July 2025 Data)

PLEASE NOTE: Charts are now updated on a quarterly basis.

Download PDF