Builder Partnerships recently conducted a survey of our builder community in order to remain abreast of the market and its impact on our members.

Builder responses indicate changes in sales backlog, cycle times, starts and closings. While this seems to be the general trend, some markets continue to do better than others. Many builders had reduced their expectations for 2023 based on the end of 2022, and most of our responses indicate that they are tracking toward that reduced expectation with a cautiously optimistic attitude. Continued interest rate adjustments by the Fed are impacting buyer affordability and the ongoing uptick in inflation continues to affect pricing. Still, the need for homes has not abated and both builders and consumers recognize this fact, and the industry continues to adjust and move forward to meet the need.

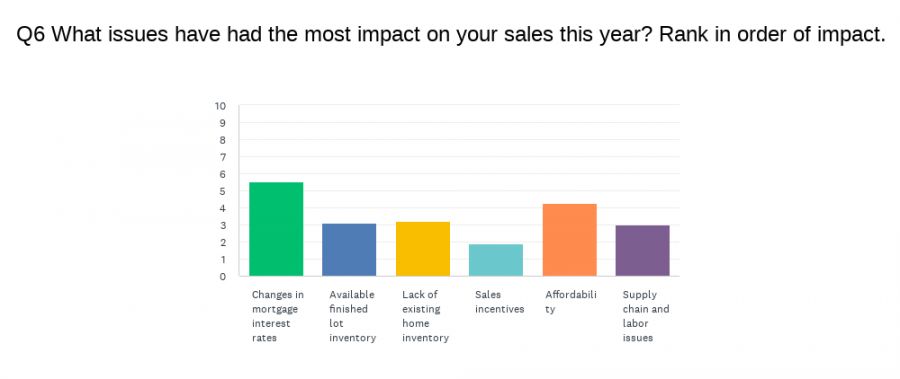

Projections related to sales contracts are showing an interesting trend, as 64% of respondents said they are projecting a number that tracks with their original 2023 estimate, with an additional 21% saying they are tracking higher than originally predicted. The main issues cited as impacting sales came as no surprise. Changes in mortgage interest rates was the most common response, followed by affordability, and then lack of existing home inventory and availability of finished lots. Here are the responses related to sales contracts:

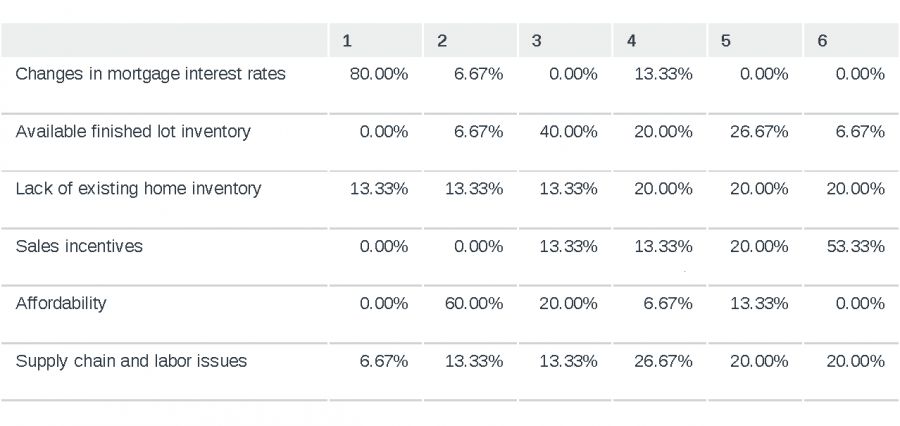

Here is the response breakdown when asked what actions builders are taking to counter any decreases in sales/contracts/closings (note that multiple answers were acceptable):

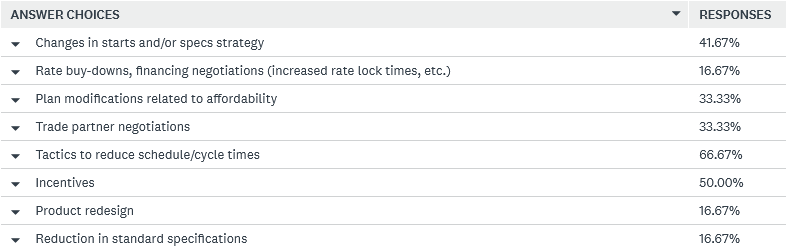

With approximately 67% of builders saying they are using tactics to reduce schedule/cycle time, survey results indicate cycle times are getting closer to pre-pandemic norms for our respondents:

Many builders are evaluating their businesses due to these factors and the continued unease they feel about the market for the remainder of 2023. When asked about the changes they are making to their businesses for the remainder of 2023 and into 2024, their answers were:

Approximately 70% of respondents are evaluating risk and 31% are evaluating banking and financing strategy! That is sound business strategy in any market, but particularly in this one. As the respondents could choose multiple answers, you’ll note that 31% are increasing the number of starts/specs and 31% are curtailing the number of starts/specs. Answers related to an increase or decrease in starts/specs appears to be somewhat regional in nature. Builders in the Southwest and Canada responded that they were increasing starts, however, Midwestern and Southern respondents are generally curtailing starts. We also made note of the fact the none of our participants were revising long term growth/financial projections. This indicates that many view the current environment as a short-lived, or transitory, market factor for them.

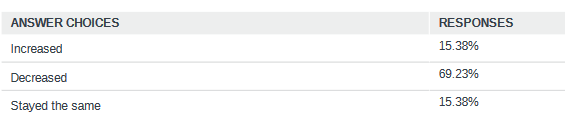

Backlogs have continued to dry up, as 69% of builders surveyed said their backlog had decreased.

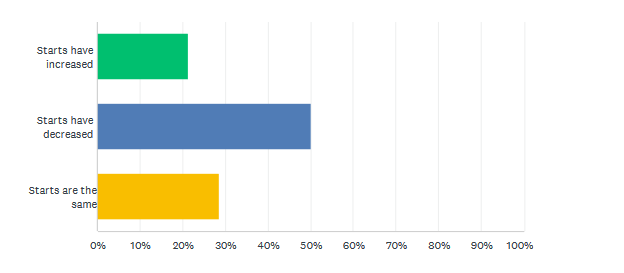

Starts have also decreased through the first five months of the year according to our respondents.

This follows what our president, Chuck Shinn, reported in his most recent article, RECESSION ROULETTE:

“Total housing starts in 2022 were down by 3.0% from 2021. Single-family starts declined 10.8% with activity slowing in July through the rest of the year due to mortgage rate increases. Multifamily starts increased in 2022 by 15.5%. This year, total housing starts are down 15.5% from last year, with single-family starts off by 24.3%. Multifamily starts are ahead of 2022 year-to-date by 3.2%. May total housing starts snapped back with a 21.7% increase from April, and a 5.7% increase from last year. Single-family starts increased 18.5% from April, but remain behind the start rate recorded last May. Multifamily starts in May increased 28.1% from April, and 39.6% from last May. The multifamily segment of the housing market is still showing strength.”

Many builders have experienced some slowing in permitting as well. Contributing factors include code changes, increased municipality time to permit issuance, and others. Chuck’s article touches on the numbers:

“Total new home permit activity was down 4.1% in 2022 from 2021. Single-family permits were down 12.5% while multifamily permits increased 10.9%. This year, total permits are down 19.8% from 2022, with single-family permits off 25.5% while multifamily permits have declined 9.9%. Total May permits increased 5.2% from April, with single-family permits up 4.8% and multifamily up 5.5%. Compared to last year, total permits are down 12.7% with single-family permits down 13.2% and multifamily down 12.3%.”

Results indicate we could see an increase in starts moving into the back half of 2023, which bodes well for sales and closings in the first half of 2024. May's start rate was the highest since April 2022, which was then the highest since 2006. This provides support for some reports in the broader market/media that housing may have already seen its recession. However, that is yet to be determined, as the Fed will likely raise rates again at its next meeting which will likely have a negative impact on housing moving forward. The Fed continues to indicate that it will likely raise rates at least twice between now and the end of the year.

Results from our prior survey indicated that general builder sentiment for the home building industry for the second half of 2022, was as follows:

The middle-of-the-road sentiment was no surprise given the level of uncertainty facing the industry. While we did not re-ask this question in our most recent survey, the results tell us the story has not changed. On one hand, high demand is giving builders a reason to be optimistic. On the other hand, affordability issues due to increased and unstable interest rates continue to curtail demand. Home builders need to be prepared for continued volatility in the near term. In the longer term (2024-2030), the market should stabilize and get back to a more normal trajectory.

As a reminder, simply lowering prices is not the solution to current market issues. To protect profit margins, builders may need to redesign their homes and build more efficiently to reduce operating expenses. This can increase the attainability factor for buyers and impact your sales and closings.

Builder Partnerships is committed to monitoring the housing industry and sharing trends and analysis with our community of builders, manufacturers and service providers. We wish to thank everyone who took the time to complete the survey. We appreciate your participation.