Housing experienced a turbulent year in 2024, and all signs point to more rough seas for the industry during 2025. There were four major headwinds for housing this past year: stubbornly high inflation, the FED monetary policy of increasing interest rates to counter inflation, housing affordability, and increasing high mortgage interest rates. For 2025, there are two more headwinds the industry is going to have to fight: the crackdown on illegal immigration which will impact construction labor, and tariffs which will impact construction material costs.

Inflation

In June 2022, consumer prices rose by 9.1% on a yearly basis which was the largest rise since November 1981. It has been nearly a three-year battle to get inflation under control by the FED through monetary policies hiking interest rates a total of 11 times, starting in March 2022.

Inflation has been very stubborn with the headline and core Consumer Price Index (CPI) stronger than expected in January at annualized increases of 3.0% and 3.3% respectively. The headline and core Producer Price Index (PPI) rose 3.5% and 3.6% on an annualized basis in January. The PPI is an index on the input prices paid by businesses which is a leading indicator of what is going to happen to consumer prices. At the end of 2024, the Personal Consumption Expenditure Index (PCE) was at 2.8% and is expected to rise to 2.9% for the first reading this year. This is considerably higher than the FED target of 2.0%.

Efforts to calm inflation moving forward will be rather choppy, especially with the potential impact of new tariffs being implemented. Businesses will raise prices in anticipation of the tariffs, and there will be little incentive to ease on pricing under current conditions.

FED Actions

Beginning in March 2022, the FED increased interest rates 11 times through July 2023, when it made its final 0.25% increase which increased the target range for the FED funds rate to 5.25%-5.50%. The rate did not change again until September 2024. The FED reduced its target rate by 50 bps in September, 25 bps in November, and another 25 bps in December, for a total drop of 100 bps. It seemed like the FED was playing politics at that point. When the FED dropped rates, the battle with inflation was not over.

The first 50 bps drop impacted mortgage interest rates and stimulated the housing market. However, mortgage rates bounced back and the additional FED interest rate drops had little impact.

Based on the returning strength of inflation, there are no further actions planned by the FED to drop rates until the end of the year (two 25 bps drops). These anticipated drops are now questionable. The earliest FED action may be postponed until the first half of 2026.

Mortgage Interest Rates

The Feddie Mac 30-year fixed mortgage interest rate was rather erratic during 2024. At the beginning of the year, it was at 6.62%, it rose to 7.22% by May 2, it dropped to 6.08% in September at the first FED funds rate reduction, and then increased to 7.04% on January 16, 2025.

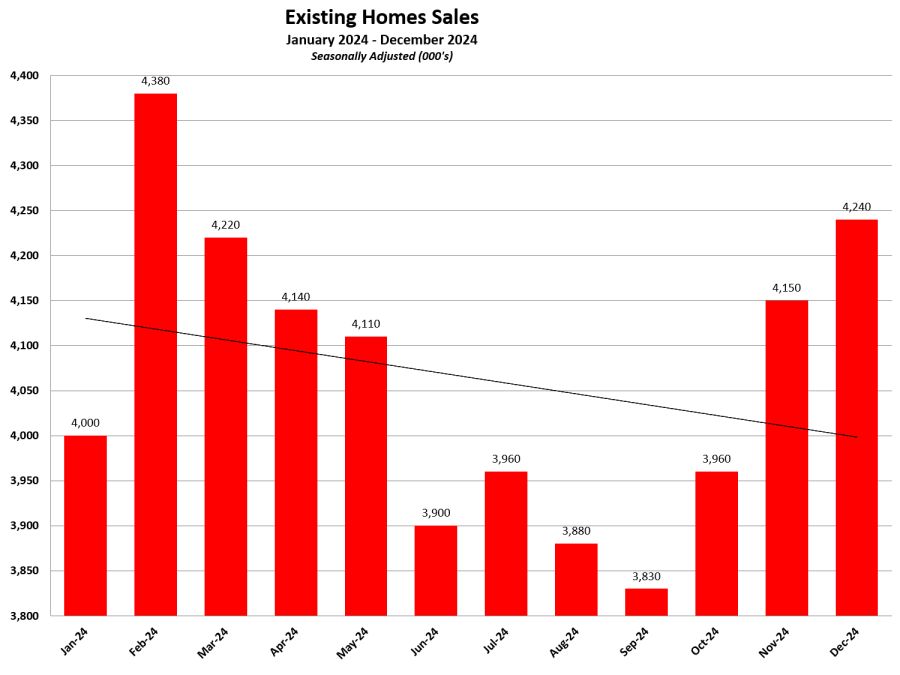

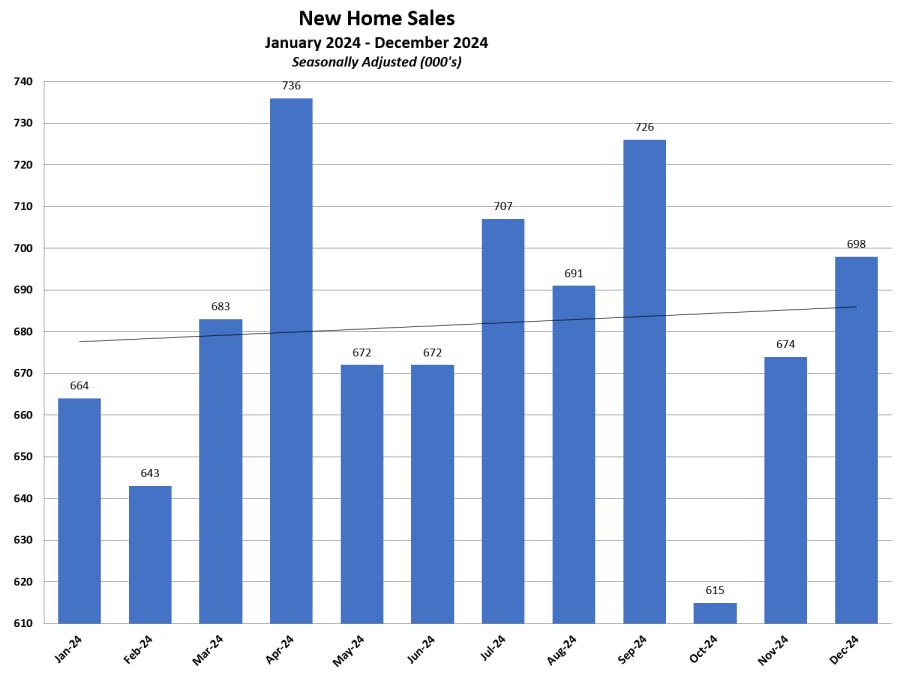

Home sales, both existing and new, generally have followed the mortgage interest rates. Sales seem to be stimulated when the interest rate drops below 6.5% and subside when rates approach 7.0%. At the end of 2024 and the beginning of this year, the mortgage interest rate was hovering around 7.0%. This will most likely be the story for most of 2025 now that the FED is in a holding pattern.

With the fluctuation of mortgage interest rates impacting home sales, one of our builder groups established a monthly meeting to closely monitor sales traffic (foot and online), sales (gross and net) compared to projections, and what sales incentives are being offered.

Housing Affordability

The median sales price for existing homes reached a record high of $407,500 in 2024 which was a 4.7% increase from 2023, and a 5.5% increase since 2022. There has been very little existing home inventory over the last several years with many homeowners with low mortgage rates holding onto their homes. Currently there are only 3.7 months of supply on the market. For a balanced market, there should be about six months of supply.

For new homes, the median sales price actually decreased 2.0% from $428,600 to $420,100 for the year. Compared to 2022, the median price dropped by 8.2%. This is a result of changes in the product mix, builder incentives, and mortgage rate buydowns.

In 2024, the spread between the median sales price for new homes and existing homes was only $12,600 or 3.1%.

Currently, there is an excess of new home inventory with 8.7 months of supply, 25.0% of which are completed for sale. Additionally, many builders began building speculative homes preparing for the spring selling season. These homes will be added to the completed inventory if a strong selling season does not materialize.

Many builders implemented mortgage rate buydown programs to counter the current high interest rates. These programs have been very successful. Cornerstone Home Lending, a member of Builder Partnerships, has a good program.

Illegal Immigrant Crackdown

The construction industry has historically been a gateway for immigrants coming to the United States. The current crackdown on illegal immigrants is causing concern for home builders regarding availability of adequate labor resources. How big of an issue this will be is unknown, but it does add another caution and uncertainty for 2025.

Tariffs

The threat of tariffs is another uncertainty for 2025. There is a lot of concern about the tariffs being inflationary. Based on an anticipated impact of up to 10% on construction costs, some builders are considering increasing prices 1.0% per month. Other builders are taking the cautious position of revisiting their pricing on a quarterly basis.

Based on the discussions about reciprocal trade tariff matching, the new administration is most likely using tariffs as a negotiating ploy in an effort to open up our exports by having our trading partners reduce their restrictive tariffs on U.S. goods.

$1 Trillion 10-Year Tax Cut

If passed this year, the tax cut will have a psychological impact, but the consumer spending stimulus will not occur until 2026.

2024 in Review

Existing Home Market

2024 recorded the lowest sales volume since 1995, as the median sales price reached a record high of $407,500. Sales only totaled 4.06 million. The ending inventory of homes on the market increased to 1.15 million, representing 3.7 months of supply. For a healthy existing home market, there should be above 5.0 million sales and a six month inventory to allow for mobility. The existing home sales market has been stressed for the last several years.

New Home Market

Residential building permits decreased 2.6% with single-family permits increasing by 0.9% and multifamily permits decreasing 17.1%. Construction starts also dropped from 2023 by a total of 3.9% with single family starts expanding by 6.5% while multifamily start plummeted 24.9%. The cost and availability of capital, the amount of multifamily inventory being completed, and the softness of the market has all impacted the multifamily sector of the industry.

New home sales increased 2.6% over 2023, while the median sales price declined 2.0% to $420,100. Home builders were using incentives and mortgage buydowns to the tune of $15,000 or more to generate sales. Currently, home builders have excess inventory with 9.5 months of actual supply, 25.0% of which is complete.

Another explanation for the drop in median sales price is the change in the sales price mix. The share of homes sold under $300,000 increased by 22.8% from 2023 to 2024. Homes in the $300,000 to $399,999 range also showed an increase, but only by 3.6%. Homes with sales prices of $400,000 to $499,999 decreased by 3.7%. Homes selling in the range of $500,000 to $599,999 recorded the largest drop in share of sales at 7.2%. Sales between $600,000 to $699,999 dropped off by 1.2% while the $800,000 to $999,999 expanded by 3.0%. The over $1 million sales price homes were on par with 2023. What this reveals is home buyers shifted to more affordable homes and the historical heart of the market declined.

2025 is going to be a challenging year for home building with numerous headwinds to navigate. Builders need to pay close attention to their sales traffic and net sales, construction costs, schedules and availability of labor, the mortgage market, what the FED is doing, and what the new administration is doing. To prepare for a variety of outcomes, builders need to develop strategic plans involving multiple strategies for the year.

Shinn Group is here to help. In addition to our robust management training curriculum, we offer customized consulting and coaching packages designed to help home builders prepare for economic uncertainty and emerge on the other side stronger, more profitable and in a better position for growth. Contact us a 303-972-7666 or info@theshinngroup.com for details.

Join us at the 2025 Executive Summit and discover how to market-proof your business for resilience in uncertain times.