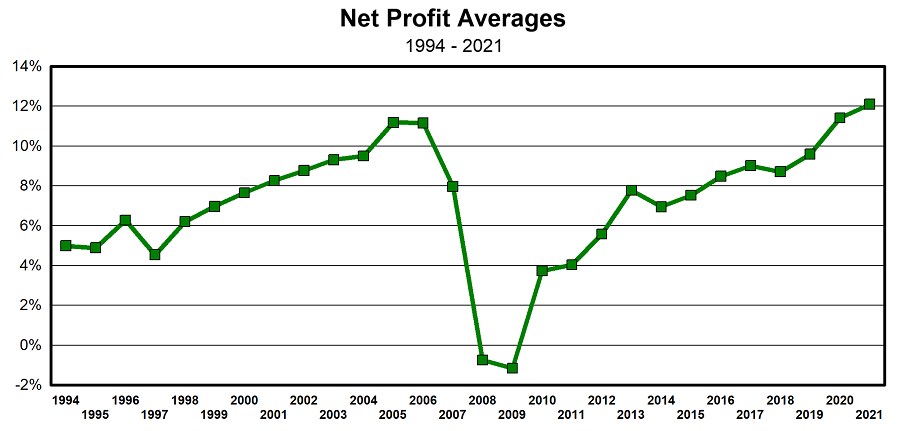

The study shows 2021 as a record breaking year for profitability and volume. Volume increased 18 percent with 45 percent of builders earning more than 10 percent net profit, and 38 percent earning more than 12 percent net profit. Four builders reported losses for the year in the under $20 million quartile. Two of the companies are startups where closings have not yet reached the anticipated numbers. For small companies, loss of closings typically have a greater negative impact on profitability.

Unlike in 2020, when most of the builders participating in the study with sales under $50 million experienced below-average profitability, builders of all sizes were able to achieve superior profitability in 2021. Even though 2020 was a record-breaking year for profits, only builders with volumes of $50 million or more reported higher than average profitability for the group. Small builders appeared to have been less equipped to react and make the necessary adjustments required to thrive during the pandemic.

Technology and strong, solid relationships with trades and suppliers gave the medium to large size builders the edge in 2020. They had been expanding the use of technology in the sales process prior to the pandemic, therefore, it became significantly easier to accelerate and immediately implement website changes to facilitate selling through the internet. However, it did not take long for small builders to react to the new market conditions. Even though markets have returned to more of a face-to-face environment to some extent, small builders have brought their technology reach more in line with present market demands.

On the 2020 and 2021 financial charts showing net profits by ascending volume, you can follow the rebound of the small builders. NAHB reported a year of losses in 2020. Even though we do record builders with losses for this group in 2021, we did not see losses in 2020, and we saw a quick rebound in profitability, as a group, during 2021.

What continues to hold true year after year are the two elements required to maximize profitability: the cost of the product and the efficiency in managing the operation.

Product cost – The cost of the product includes the cost of the sticks, bricks and the labor to put them up. However, it is multi-faceted, as many other elements have a significant impact on what the cost ends up to be. Elements such as design, specifications, estimating and purchasing processes, negotiations, utilization of materials, waste control, and others.

Efficiencies of operations – Efficiencies are generally associated with time and productivity of the construction management process as carried out by the staff. This segment requires organization and standardization of processes and procedures preparing for the building cycle as well as superior execution during the construction cycle.

The results of the study demonstrate a high number of participants achieving both: control of product cost (shown by the gross profit) and high efficiencies in the production operations. These two elements combined create superior results and demonstrate excellence in the management process.

As we compare net profit to gross profit (revenue minus land and direct construction cost) in ascending volume, it is easy to see the most profitable companies, regardless of size, are those with the highest gross profit. In a few instances, we can see that operating expenses have depleted profitability, thus highlighting the importance of a well-run and efficient operation.

Looking at 2022, the hard part is making the necessary adjustments to maintain a sustainable level of profitability and react adequately to the challenges facing the housing industry. Unfortunately, the political environment is creating most of the challenges, as the demographics and the outlook for housing demand for the rest of this decade is still very strong.

More than ever, builders need to adopt the following management practices:

- Schedules are critical

- Incorporating lead times into schedules is critical

- Tracking the backlog is critical

- Tracking website and on-site traffic is critical

- Tracking new sales contracts and cancellations is critical

- Tracking the relationship of sales dollars per employee is critical

- Good estimating and purchasing systems and procedures are critical

- Good accounting practices integrated with back office procedures are critical

- Analysis of the different profit centers is critical

- Site supervision to drive efficiencies and maximize material use (decreasing waste) is critical

Download a copy of Chuck Shinn’s special report titled The Roaring 2020s and discover why this decade is poised to be the best decade for housing demand in U.S. history.