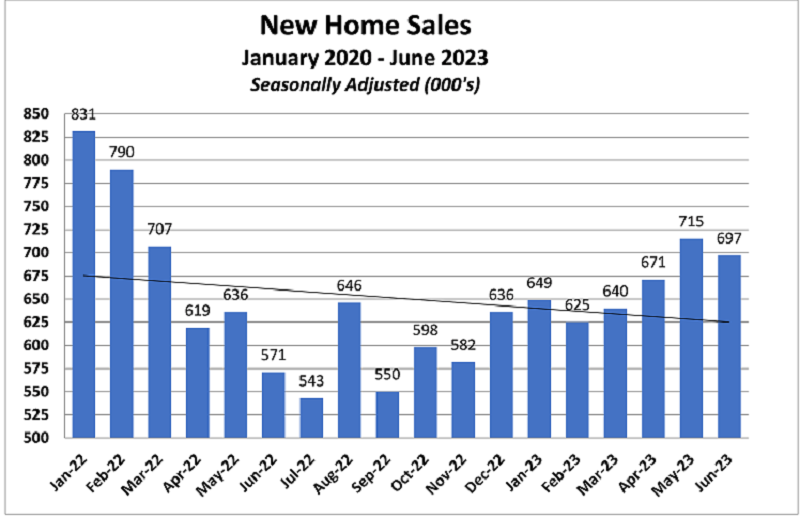

The first six months of 2023 far exceeded home builders’ expectations from the beginning of the year. Builders were forecasting a 30% drop in home sales based on the fall off of sales during the fourth quarter of last year when the interest rate for a 30-year fixed rate mortgage increased to over 7.0%. At the half-year mark, actual new home sales were only down 2.8% from last year.

This decade, the demand for housing is very strong, beginning with an estimated housing short fall of approximately three million homes. Baby boomers and millennials are on the move, and Gen Zs are now entering the housing market. For an in-depth look at housing demand, download my white paper, The Roaring 2020s: Housing’s Best Decade from our website.

Since March 2022, the Federal Reserve has been fighting inflation with monetary policies, raising the fed funds interest rate 11 times (550 bp). The Fed is rolling off its balance sheet $60 billion in treasury securities and $35 billion in mortgage-backed securities to gain control of inflation which reached 9.1% in June of last year. As a result, the Freddie Mac 30-year mortgage interest rate increased from 3.22% at the beginning of the year to 7.08% in October, which killed the housing market in the last quarter of 2022. That, along with the anticipation of an economic recession during the first half of this year, set the stage for expectations for this year.

The rapid increase in construction material and labor costs, especially lumber, caught home builders by surprise, depleting their margins on pre-sold homes. Supply chain issues and skilled labor shortages drastically extended construction times. In response, builders moved from a pre-sale model to a rapid delivery model for sales. Home buyers were put on waitlists, homes were started before sales, and at the completion of the framing stage of construction, homes were priced and sold. This mitigated the effects of rapidly rising costs and extended schedules.

As the housing market softened during the second half of 2022 due to high interest rates, there was an increase in unsold inventory. The cost of construction receded, and construction schedules began to return to normal due to improvements with both the supply chain and skilled labor availability.

Concerned about sales cancellations, liquidation of unsold inventory, and future sales due to the rise in mortgage interest rates and affordability issues, builders began offering buyers incentives of mortgage rate locks, mortgage rate buydowns, home price discounts, and free upgrades. Because of the reduction in construction costs, builders had strong margins and were able to offer incentives totaling as much as $50,000.

In 2022, existing home sales plummeted 25.6% from January to July, to below a 5.0 million annualized rate in response to mortgage rate increases. It dropped another 13.7% to an annual rate of 4.16 million in June 2023. For the first six months of this year, existing home sales were down 23% from the same period last year.

Inventory of existing homes has remained exceptionally low, with a typical home staying on the market in May and June for only 18 days and 76% of homes sold within 30 days. Currently, there is little hope for the inventory of existing homes to expand anytime soon because homeowners are remodeling to keep their current low mortgage interest loans. According to the Federal Housing Finance Agency, only 9% of all existing mortgages have a rate over 6%, while 38% of mortgages have rates between 3% and 4%, and another 23% have rates less than 3%. The lack of inventory has caused the median existing home sales price to increase to $410,200 in June which is the second-highest price ever recorded since January 1999. This was only 1.3% below the median new home sales price of $415,400. In today’s market, new homes are at a competitive advantage with the availability of rapid delivery homes, mortgage interest rate assistance, and buyer incentives.

For the first half of this year, total building permits are off 19.2% from 2022. Single family permits are down 21.5% while multifamily permits are down 15.4%. However, single family permits have increased each month, totaling a 71.0% rise since January. Multifamily permits, on the other hand, have been decreasing steadily as increased interest rates, deteriorating cap rates, tighter loan standards, and a near record amount of new apartment construction near completion have forced developers to postpone projects.

Total new home construction starts for the first six months were down 15.0%. Single family starts declined 21.1% during the first half of this year, but have been increasing each month for a total monthly improvement of 56.1%. Multifamily starts are only off 1.3% with no actual positive or negative monthly trend.

New home sales registered a drop of 2.9% in the first six months of 2023. The majority of the decline was in the West with a decrease of 16.5%. The Midwest recorded a loss of 7.6%. The South and Northeast both recorded increases (3.2% and 4.7% respectively). Eighty-three percent of the homes sold were either under construction (42.9%) or completed homes (40.1%). Only 17.0% were homes not started. The median sales price has dropped 3.9% since January to $415,400 in June.

A word of caution going forward: There will be a recession! Economists have pushed back the recession until the first half of 2024, and are forecasting a mild recession. However, the economy is still too strong, and there will probably be two more interest rate increases by the Fed this year. Consumers are still spending money like drunken sailors. Employment has softened, but it is still too strong for the Fed.

Home builders seem to have a sense of euphoria. The builder confidence index for the market of newly built homes rose five points in June to 55. There is a feeding frenzy for land. Builders are expanding their speculative building to offer more rapid delivery homes. After 55 years of observing and analyzing the home building industry, I recommend builders be cautious. This sense of euphoria has occurred before every housing recession. We may be in a period of calm before the storm. There are too many storm clouds on the horizon. And we are coming into a very contentious presidential election year.